Chatting with Ian Shimizu of WeMori: The Potential of Carbon Coins

Regular lunch with Ian Shimizu of WeMori, a company that focuses on protecting forests to prevent global warming.

Every time we meet, we give each other new inspiration.

What was interesting this time around was that I was told about a book, The Ministry for the Future, by science fiction author Kim Stanley Robinson, although it has not yet been translated.

Set in the near future, the novel centers on Mary Murphy (modeled after the former Irish foreign minister), head of the Ministry of the Future, a Zurich-based agency established in 2025 under the Paris Agreement, and Frank May, an American who has experienced a heat wave in India.

The issue of global warming is set as a threat to future security and prosperity.

Murphy works hard to convince central banks that worsening climate change will undermine the stability of “currencies and markets. Specifically, a “carbon coin” could be issued globally, a highly discounted currency in exchange for carbon capture.

The more carbon coins they add, the more revenue they generate for the country.

In fact, this idea itself is not nonsense and impossible to talk about.

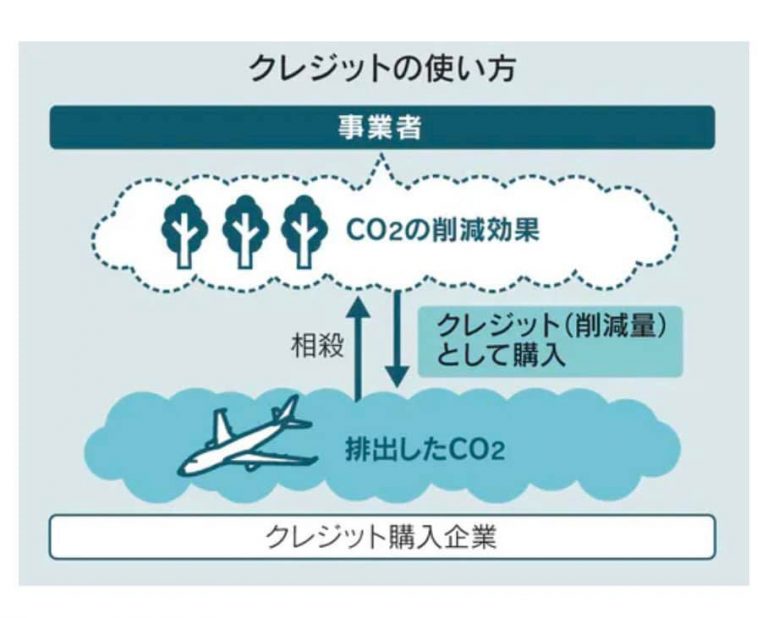

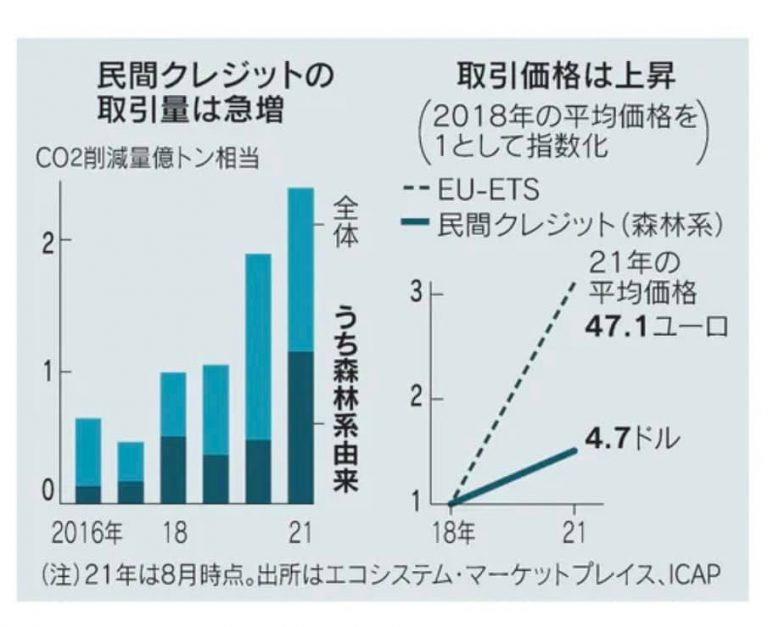

Currently, if a company emits more than a set amount of carbon dioxide, it must purchase carbon credits to offset the carbon emissions.

While the European Union’s emissions trading scheme requires companies to participate, in Japan, participation is voluntary and without penalty.

For example, let’s say a company is still unable to make the carbon reductions it has decided to make due to its equipment and other reasons. The company would buy the difference from a company that is reducing carbon emissions for 47 euros per ton. The company that buys the carbon reductions recognizes the difference as a cost, and tries to reduce the cost more in the next year, thereby improving the global environment.

The book proposes the idea of making emissions trading a liquid financial market in the form of “carbon coins”. Interesting. I was thinking the same thing.

All markets are based on the balance of supply and demand. If companies that can reduce carbon emissions and those that can’t engage in friendly competition, the earth may become healthier at an early stage.

P.S.: If “carbon coins” become an item like a virtual currency, it will bring in money for investment purposes and help reduce carbon emissions even more. Also, if the “carbon coins” become digital property, it would be possible to expense not only the parties involved but also the third party who purchased the “carbon coins”. Currently, carbon credits are deductible.

◆ Notes

What are Carbon Credits? Expanding the Private Market for Global Warming Solutions: Nihon Keizai Shimbun

JPX and METI to Establish Emissions Trading Market, Demonstration Test to Begin in September: Nihon Keizai Shimbun

The Ministry for the Future

Accounting Q & A|Carbon Offset Forum