A mirage-like art market created by the world’s “money glut

April 2021.

Although the general public may not realize it due to the Corona disaster, there is a “money glut” worldwide.

There have been several bubble periods like this in the past, all of which have collapsed.

The bursting of the bubble in 1992 was caused by banks extending extended loans to purchase real estate without collateral, and land prices rose abnormally. It collapsed in a stupefying manner when the monetary easing policy was stopped in order to stop them.

The Lehman Brothers collapse in 2008 was caused by lots of delays in mortgages (subprime) to people with poor credit. It collapsed due to the global credit crunch, not the siphoning off of funds from monetary easing as in the bubble economy.

And 2021.

Now they call it the Corona Bubble.

The spread of the new coronavirus has caused countries to take competing “easy money” measures, causing stocks and crypto assets (virtual currencies) to soar.

At present, there is little likelihood of a siphoning off of funds as in past bubble bursts, and stock prices are high relative to the actual stock prices and earnings performance of companies. The market is in a state of flux.

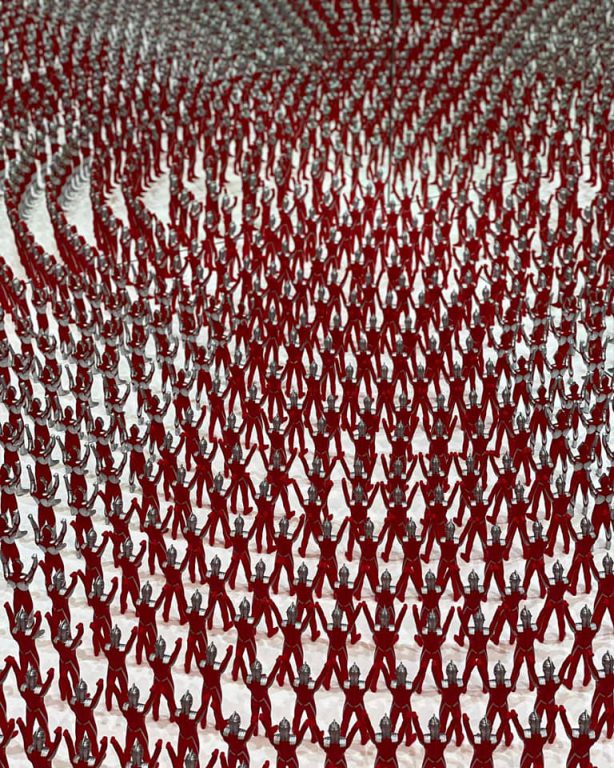

Against this backdrop, a large amount of money is being invested in contemporary art. The recent “Art Fair Tokyo 2021” (2021/03/18 -19th) was brisk despite the absence of overseas collectors. The traditional buyers of antique art have gone into the shadows, and Japanese IT chiefs have begun to buy “contemporary art” as an asset.

Two months before the fair, SBI Art Auction held an auction in Daikanyama, Tokyo, for a work by Ayako Rokkaku, with an expected bid price of 10-15 million yen. It was sold for 26 million yen (excluding commission).

Thus, huge sums of money are floating around in the mysterious stagnation of the Corona disaster.

I hope it won’t be the way I came someday.

◆ Reference

IT entrepreneurs are buying up “art investments,” and money is pouring in in droves in anticipation of higher prices.

The Real Value of Money is Decreasing due to the Corona Bubble How to Protect Your Valuable Assets | New Race-Loving Economist’s In-Depth Market Reading Theater – Toyo Keizai Online