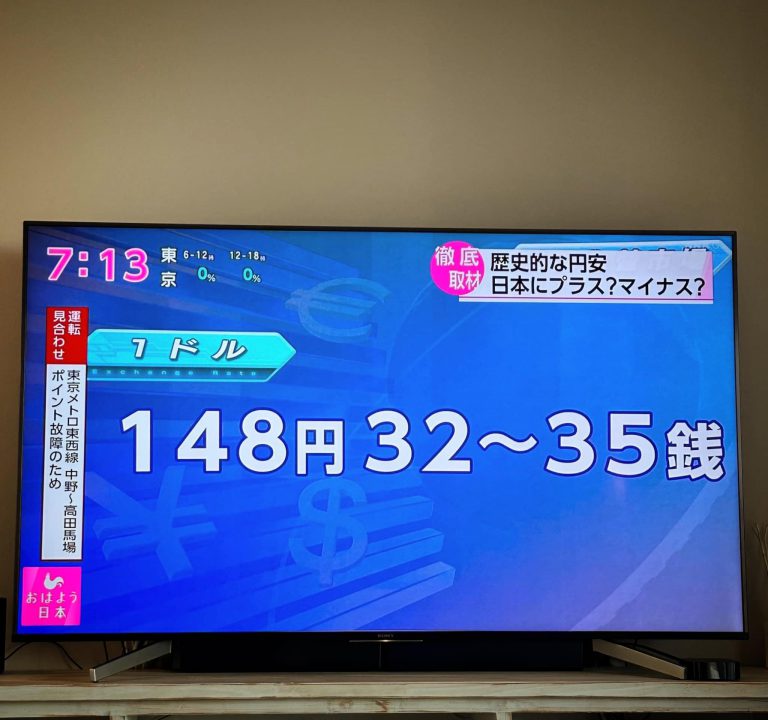

A weak yen can only be a good thing. (I guess we should look at the good things about a weak yen)

In the past, export-oriented Japanese companies that suffered from the strong yen have moved their factories and other facilities overseas. Measures have already been taken to mitigate the impact of the exchange rate. Of course, a weaker yen means that domestically produced goods will sell better overseas.

So, corporate earnings, including Uniqlo, are at record highs, corporate tax revenues are at record highs, and GDP will also be boosted.

In addition, the government has about $1.3 trillion in dollar reserves (U.S. Treasury bonds), and there is about 30 trillion yen in foreign exchange gains from the recent sharp depreciation of the yen. And this is not being used to fund the supplementary budget, economically illiterate Prime Minister Kishida!![]() KDP Representative Tamaki was correct when he pointed out in the Diet that “the government will be happy.

KDP Representative Tamaki was correct when he pointed out in the Diet that “the government will be happy.

Do not be mind-controlled by the media that a weak yen is bad. A strong yen and a weak yen are both good and bad, but a weak yen is easier to leverage for policy. The media should report the facts properly. There is too much mood reporting (impressionistic criticism). I always wonder, “Is that so? and then I look up the supporting facts (figures from the past and other developed countries) and compare them.

Foreign investment in tourism and real estate will also be stimulated, and Ginza’s explosive growth is greater than expected.

Will there be an increase in startup investment in Japan from abroad?

Now is the time to implement policies to increase domestic employment and income.

In other words, we should be able to take more agile policies than a strong yen. Politicians, please, study the economy and make Japan “Great” again!![]()

◆ Notes

Corporate income exceeds 79 trillion yen, a record high. Taxes are 75% of those during the bubble period, FY2009 – National Tax Agency

https://www.jiji.com/jc/article?k=2022103100804&g=eco

<Opinion> Corporate income is the highest in Japan, and the environment is ripe for higher wages: Tokyo Shimbun TOKYO Web

https://www.tokyo-np.co.jp/article/211517

Signs of a resurgence in “explosive buying” due to the weak yen, and even Nishikigoi priced at over 1 million yen are “on bargain sale”.

https://news.yahoo.co.jp/…/2812a83a54ea2be19c13c936d38e…

End Deflation after 30 Years of Rising Prices and Wages: Nihon Keizai Shimbun

https://www.nikkei.com/article/DGXZQOUA193CY0Z11C22A0000000

Japan’s Foreign Exchange Reserves Exceed $1 Trillion, 4 to 13 Times Greater Than G7 Countries, 90% of Foreign Exchange Special Interest Group: Tokyo Shimbun TOKYO Web

https://www.tokyo-np.co.jp/article/211227

Comparison of Price Increases in Japan, the U.S., and Europe – Japan’s Rate of Price Increases Exceeds 2%, but Differences from the U.S. and Europe at Around 9%? | Osamu Tanaka | The Dai-ichi Institute of Life Economics

https://www.dlri.co.jp/report/macro/193944.html

Recent Posts

- 2/9~2/25 “Non Ribbon Exhibition – Weird and Cute Things. SPECIAL DISPLAY will be held at Sendai PARCO. Free Admission

- NON will appear in “AERA” on sale on Monday, Feb. 5th in the serial article “Creating Tomorrow’s Smiles Together”.

- QWS STARTUP AWARD#2, a pitch award for startups to promote society and business one step further

- LINE Stamps [Mr. F’s Smile and Good Luck! Released today!

- Director Ikumi Ogawa was nominated for Best Director in Television/Media at the 51st Annie Awards for his Netflix production of “Pokémon Concierge” (episode 2), in which Non plays the voice of the main character Hal!

Archives

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- December 2017

- September 2017

- July 2017

- June 2017

- May 2017

- March 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- April 2016

- March 2016

- November 2015

- August 2015

- July 2015

- December 2014

- November 2014

- August 2014

- December 2013

- August 2013

- November 2012

- October 2011

- June 2011

- April 2011

- March 2011

- November 2010

- October 2010

- September 2010

- August 2010

- April 2010

- April 2009

- July 2008

- May 2008

Categories

- Activity(Event)

- Actor / Actress

- Angel investment

- Art

- Art History

- Associated c project

- Bar

- Book

- Brand Consulting

- CEO Chronicles

- China

- Customer Service

- Farm

- Fund Raising

- Mindfulness

- Musician

- NEWS

- NFTs

- Online

- Resort

- Social Impact

- Talent agency

- Technology

- YouTube

- 当代艺术家(Contemporary Artist)

- 影院剧场(Theater)

Recent Posts

- 2/9~2/25 “Non Ribbon Exhibition – Weird and Cute Things. SPECIAL DISPLAY will be held at Sendai PARCO. Free Admission

- NON will appear in “AERA” on sale on Monday, Feb. 5th in the serial article “Creating Tomorrow’s Smiles Together”.

- QWS STARTUP AWARD#2, a pitch award for startups to promote society and business one step further

- LINE Stamps [Mr. F’s Smile and Good Luck! Released today!

- Director Ikumi Ogawa was nominated for Best Director in Television/Media at the 51st Annie Awards for his Netflix production of “Pokémon Concierge” (episode 2), in which Non plays the voice of the main character Hal!

Archives

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- December 2017

- September 2017

- July 2017

- June 2017

- May 2017

- March 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- April 2016

- March 2016

- November 2015

- August 2015

- July 2015

- December 2014

- November 2014

- August 2014

- December 2013

- August 2013

- November 2012

- October 2011

- June 2011

- April 2011

- March 2011

- November 2010

- October 2010

- September 2010

- August 2010

- April 2010

- April 2009

- July 2008

- May 2008

Categories

- Activity(Event)

- Actor / Actress

- Angel investment

- Art

- Art History

- Associated c project

- Bar

- Book

- Brand Consulting

- CEO Chronicles

- China

- Customer Service

- Farm

- Fund Raising

- Mindfulness

- Musician

- NEWS

- NFTs

- Online

- Resort

- Social Impact

- Talent agency

- Technology

- YouTube

- 当代艺术家(Contemporary Artist)

- 影院剧场(Theater)